Alternative to Traditional Equities

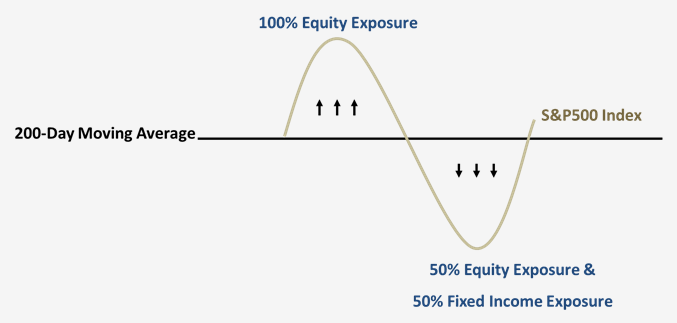

RBIs provide highly efficient access to frequently rebalanced long-equity strategies. Clients may use these notes to participate in international equity markets and sectors, thereby diversifying their equity holdings. Other asset classes, such as fixed income, can be applied to these notes and are dynamically accessed. This is beneficial to clients wanting to vary their participation in both the equity and bond markets during unstable market conditions. Currency hedges are also offered on a variety of notes. These hedges are best for clients wanting global exposure to equity markets, but want to reduce the uncertainty of currency fluctuations.

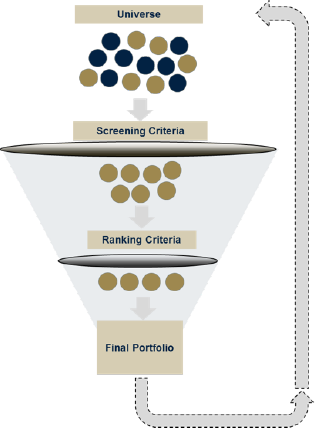

Systematic Investing

Because these securities are rules-based, the emotional aspect of investing is removed. The Securities follow the pre-defined strategy throughout their term, and market exposure is either increased or decreased depending on the rules of the strategy.

Customizable Products

The strategies are typically designed by RBC Research but can also be customized to reflect individual investment views. For example, an advisor and/or client may choose the initial portfolio of shares, the strategy that governs future share selection, and whether a currency hedge is required.

Operationally Efficient

RBIs are efficient because they offer a “one-ticket solution”. RBC teams trade the underlying shares and rebalance each portfolio. All costs to investors are reflected in the annual fee. RBC offers a daily secondary market for clients wishing to redeem positions prior to maturity.

- These notes are not principal protected.

- Investors may lose all or part of their principal invested in the securities.

- Strategies are pre-defined and cannot be changed during the term of the note. RBI investors can sell an RBI in the secondary market if their investment view has changed.