Customized Equity Investing

NPPNs deliver tailored exposure to equity markets. Investors may customize the level of upside participation and exposure they want to equities. In markets with high expected growth, clients may consider growth products, such as an Accelerator or Booster (described below). These products provide enhanced participation in the positive performance of an equity market. For investors that require income, a Fixed Yield or Callable Yield product (described below), which provides the chance to earn above-market coupon payments, may be appropriate.

Risk Tolerance

Investors may also choose the level of protection they need by customizing an NPPN to accommodate their risk tolerance. Note features such as Buffers (partial protection) and Barriers (conditional protection) can provide various levels of principal protection to clients while still offering an equity-like return in positive markets.

Flexible and Timely Issuance based on current market conditions

NPPNs can be customized and available for purchase within a very short time-frame, typically a few days. Clients can participate in NPPNs when it best suits their investment outlook.

Transparent, Passive and Formulaic

The return on NPPNs is based on a formula so the current performance of the notes can easily be calculated at any point throughout the term of the note. The return formula is pre-determined before note issuance and the return calculation is therefore highly transparent.

- These notes do not offer full principal protection so investors may lose all or a part of their initial investment.

- Return formulas are pre-defined and cannot be changed during the term of the note. NPPN investors can sell an NPPN in the secondary market if their investment view has changed.

- The investor is exposed to negative performance of the underlying equity investment, unless some level of protection is built into the strategy.

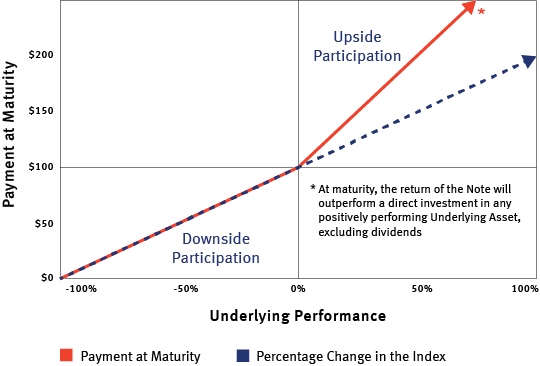

- Although investors might hold a note linked to an underlying equity investment that generates dividends, NPPN investors do not receive these dividends.

How it works

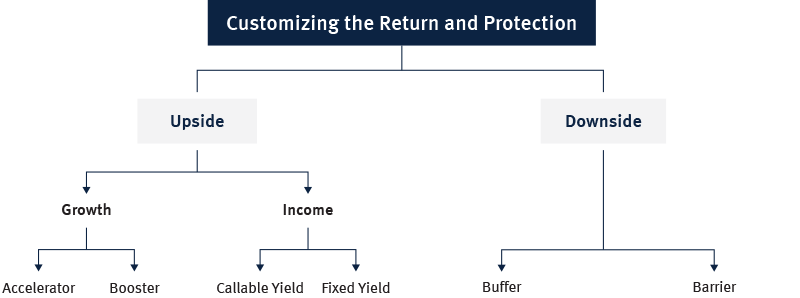

Customizing the Return and Protection

Investors have the option to choose from Growth or Income Notes.

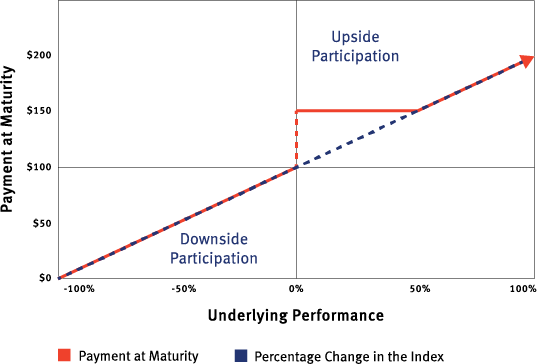

Accelerator

Provides a multiple of the performance of an equity investment if its performance is positive at maturity.

Booster

Provides a minimum return at maturity if the performance in the underlying investment at maturity is positive and less than the stated Booster Amount.

Callable Yield

Are callable at a price equal to the original investment amount plus a return, if the equity investment is not below a pre-specified level

Fixed Yield

Pays guaranteed payments, often in the form of Return of Capital payments, on a regular basis and usually offers conditional principal protection at maturity.

Buffer

Protect an investor from a stated decline in the performance of the equity investment at maturity.

Barrier

Principal protection is conditional on the performance of the equity investment on the maturity date.